XRP Price Prediction: Bullish Fundamentals Signal Potential Breakout Toward $40

#XRP

- Technical Consolidation: XRP is testing key support levels with mixed technical indicators suggesting potential breakout above $3.30 resistance

- Fundamental Catalysts: Mastercard partnership, stablecoin integration, and institutional ETF demand provide strong underlying support

- Risk Assessment: Current price action near Bollinger lower band offers favorable entry with stop-loss below $2.81 support

XRP Price Prediction

Technical Analysis: XRP Shows Mixed Signals Near Key Support

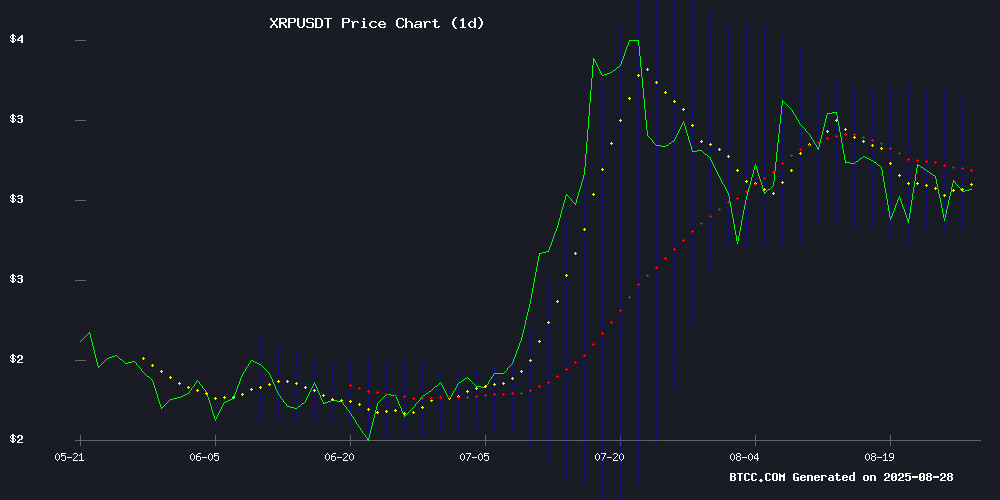

XRP is currently trading at $2.9825, slightly below its 20-day moving average of $3.0565, indicating potential short-term resistance. The MACD reading of 0.1351 above the signal line at 0.0924 suggests bullish momentum remains intact, though the histogram at 0.0427 shows weakening acceleration. Bollinger Bands position the price between the upper band at $3.2992 and lower band at $2.8139, with the middle band aligning with the 20-day MA. According to BTCC financial analyst James, 'XRP is testing crucial support levels. A hold above $2.81 could pave the way for a retest of the $3.30 resistance, while a break below may signal deeper correction.'

Market Sentiment: Bullish Catalysts Outweigh Technical Concerns

Positive developments including Ripple's RLUSD stablecoin integration with Aave, the XRP-linked Mastercard launch with Gemini, and growing institutional ETF demand are creating strong fundamental support. Despite technical indicators showing some consolidation, the news flow suggests underlying strength. BTCC financial analyst James notes, 'The Mastercard partnership and institutional interest could drive XRP beyond current technical resistance levels. The market appears to be underestimating the potential ETF demand and real-world asset integration developments.'

Factors Influencing XRP's Price

Ripple's RLUSD Stablecoin Integrates with Aave's Horizon to Bridge DeFi and Real-World Assets

Ripple has deepened its decentralized finance (DeFi) presence with the integration of its RLUSD stablecoin into Aave's Horizon Real World Asset (RWA) market. The move facilitates institutional participation in DeFi by enabling borrowing and lending against tokenized real-world assets, combining regulatory compliance with efficient liquidity flows.

RLUSD now serves as a core collateral asset alongside USDC and GHO, allowing liquidity providers to earn yield while borrowers access funds in a decentralized framework. This strategic alignment accelerates Ripple's vision of institutional-grade tokenized asset adoption, particularly in key markets like Japan.

Aave's Horizon platform emerges as a critical bridge between traditional finance and DeFi ecosystems. The RLUSD integration demonstrates how stablecoins can unlock institutional capital flows while maintaining the transparency benefits of blockchain infrastructure.

Over 100 Crypto Firms Urge Senate to Secure Developer Rights

A coalition of 112 cryptocurrency companies, investors, and advocacy groups has called on the U.S. Senate to include protections for software developers and non-custodial service providers in the upcoming market structure bill. The group warns that without clear federal safeguards, open-source developers may exit the space, stifling innovation.

Key players like Coinbase, Kraken, and Ripple signed the letter sent to Senate Banking and Agriculture Committees. The industry insists the bill must prevent misclassification of developers under outdated financial regulations. Bipartisan support for the CLARITY Act suggests broader crypto protections may gain traction.

The push highlights growing tension between decentralized technology and traditional regulatory frameworks. As blockchain development becomes increasingly global, U.S. policymakers face pressure to create rules that protect innovation while addressing legitimate oversight concerns.

Gemini and Ripple Launch XRP-Linked Mastercard with Daily Yield Potential

Gemini has partnered with Ripple to introduce an XRP-powered version of its Gemini Credit Card, expanding access to Ripple USD (RLUSD) in a strategic push for broader crypto utility. The move capitalizes on XRP's growing institutional adoption, with entities like abrdn, Braza Bank, and Societe Generale Forge leveraging XRPL's low-cost infrastructure.

Concurrently, SolMining unveiled cloud mining contracts accepting XRP and RLUSD payments, promising $7,000 daily returns on idle holdings. The passive yield mechanism requires no hardware—users simply allocate assets to activate hashrate, with automated daily settlements. Contract tiers range from $100 beginner plans to $3,000 premium options, all offering fixed-term yields.

XRP Rally Triggered by Mastercard Launch and Gemini Partnership

XRP prices surged following the announcement of a Gemini credit card powered by Ripple's technology, marking a significant milestone in cryptocurrency adoption. The collaboration enables users to earn XRP and RLUSD on everyday purchases, with Ripple CEO Brad Garlinghouse highlighting the growing demand for seamless crypto integration among 55 million American holders.

SolMining further amplified market excitement by introducing cloud mining contracts compatible with XRP and RLUSD. The passive income product promises daily returns of up to $5,000 without requiring specialized hardware, attracting both retail and institutional interest in XRP's utility beyond payments.

XRP Hovers Over Mega W Pattern, Analyst Identifies Key Level for $40 Rally

XRP is consolidating above a multi-year "mega" W pattern, a technical formation signaling potential explosive upside. Analyst EGRAG emphasizes the cryptocurrency must breach a critical resistance level to initiate a rally toward $40.

The asset recently saw volatility—surging 7.81% on Aug. 22 to reclaim $3.1, then retreating to $2.85 by Aug. 25. Despite the pullback, XRP remains above the W pattern's trendline, a structure confirmed after its January 2025 breakout.

This pattern traces back to XRP's 2018 peak at $3.31, followed by a 2020 trough at $0.1140 and a 2021 recovery to $1.96. The subsequent retracement formed the second leg of the W, now interpreted as a springboard for renewed bullish momentum.

Institutional Demand for XRP ETFs May Be Underestimated, Futures Market Signals Strong Interest

Institutional appetite for XRP-linked investment products is gaining momentum, with CME Group's XRP futures contracts surpassing $1 billion in open interest within just three months. This milestone marks the fastest ascent to $1 billion OI for any crypto futures contract on CME's platform, underscoring deepening institutional engagement.

Futures-based XRP ETFs have surged past $800 million in combined assets, led by products like Teucrium’s 2x Long Daily XRP ETF (XXRP) and Volatility Shares’ XRPI 1x Futures ETF. XXRP's trajectory—from $5 million debut volume in April to $120 million in AUM by May—has set the stage for robust demand. Bloomberg ETF analyst Eric Balchunas noted these leveraged products are attracting significant inflows despite regulatory delays.

XRP Rich List Entry Barrier Drops as Top 10% Accounts Swell

The capital requirement to enter XRP's elite holder list has softened this month, with the threshold now standing below $7,200. Data from rich-list.info reveals investors need just 2,396.7 XRP ($7,190 at current prices) to join the top 10% of addresses—a 1.5% decrease from early August's 2,433 XRP requirement.

This easing of entry conditions coincides with growing adoption, as the number of qualifying accounts expanded by 11,000 to 690,984 since August 4. The metric suggests accumulating behavior despite XRP's stagnant price performance, which shows a modest 1% decline this month.

XRP Holders Reap 5.16x Returns Amid Market Volatility

XRP investors who held the asset over the past year have realized a staggering 5.16x return on investment, according to data from Into The Cryptoverse. Despite recent price consolidation from July's peak of $3.66, the cryptocurrency has demonstrated remarkable resilience.

The ROI analysis reveals XRP's journey from $0.50 in November 2023 to its current $3.00 valuation, representing a 417% gain. Benjamin Cowen's metrics suggest the asset may still have upside potential, as risk indicators haven't signaled a market top.

Market observers note the digital asset's volatility remains elevated, with a 5.4% single-day rebound recently reclaiming the psychologically important $3 support level. The performance underscores XRP's position as one of crypto's top performers over the twelve-month period.

Pundit Advocates Buying XRP Dips, Foresees Breakout Similar to Historic $0.45-$0.55 Range

XRP's current consolidation between $2 and $3 mirrors its previous multi-year stagnation at $0.45-$0.55 before a major breakout, according to crypto analyst DustyBC Crypto. The pundit reveals aggressive accumulation during this phase, stating he's buying "like there's no tomorrow."

Market dynamics show XRP rebounding to $3 after a brief dip to $2.82, with whales capitalizing on macroeconomic pressures. The token's nine-month sideways movement is increasingly viewed as a prelude to uncharted price territory, echoing its 2021 surge from sub-$1 levels.

Forbes Outlines XRP's Growth Trajectory Post-SEC Legal Clarity

XRP's legal clarity has reignited institutional interest, with the token reclaiming its position among the top three cryptocurrencies by market cap. Trading at $3 with a $179 billion valuation, daily volumes now exceed $6 billion—liquidity improvements making it viable for large-scale adoption.

The XRP Ledger's 2024 AMM integration has deepened liquidity pools, with over 11.7 million XRP tokens locked across 22,035 markets. Payment utility beyond speculation will drive the next phase, as analysts debate whether Finder's $5 2030 projection underestimates the asset's potential.

Crypto Bitlord Threatens to Sell XRP Holdings If Price Hits $2

Prominent XRP supporter Crypto Bitlord has issued a stark warning, threatening to liquidate his entire holdings if the token's price drops to $2. A decade-long advocate, Bitlord's frustration reflects broader discontent among long-term holders as XRP underperforms expectations.

Despite a 388% year-over-year gain, Bitlord argues XRP has failed to deliver on its potential. His ultimatum—"If XRP revisits $2, I'll sell every last cent"—contrasts with some community members viewing such levels as buying opportunities.

The threat underscores growing tensions in the XRP ecosystem. While the token remains top-10 by market cap, patience wears thin among early adopters awaiting promised adoption milestones.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity with calculated risk. The cryptocurrency is trading at $2.9825 with strong institutional backing and multiple bullish catalysts.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $2.9825 | Below 20-day MA resistance |

| 20-day MA | $3.0565 | Key resistance level |

| MACD | 0.1351 (Bullish) | Positive momentum |

| Bollinger Lower | $2.8139 | Critical support |

| Potential Target | $40+ | Analyst projection |

BTCC financial analyst James suggests that while short-term volatility may persist, the combination of technical support levels and fundamental developments including Mastercard integration and ETF interest creates favorable risk-reward dynamics for medium to long-term investors.